Can’t open dealer studios fast enough: Evolution

Evolution are struggling to provide enough tables to keep up with demand.

That’s one of the key takeaways from yesterday’s Q3 Interim report presentation from CEO Martin Carlesund.

Despite operating no fewer than 15 purpose built dealer studios worldwide (that’s not including in-casino installations), and regularly opening new ones, studio capacity constraints are seen as one of the key impediments to revenue growth. They simply can’t open new dealer studios fast enough.

According to Carlesund,

“Our live casino revenue grew to €385.8m for the quarter…. and we see a higher demand for our product than what we currently can deliver. That is a measure of the phenomenal traction our games have.

However, it also means we are not expanding our studios at the right pace. We have faced delays, and in some cases not executed fully, in several of our planned studio projects for this year but even more importantly we need to increase the pace of recruitment both in existing studios as well as to support new studios.”

Studio expansion plans

In July this year Evolution launched their first LatAm studio in Argentina (Bacara Rapido pictured above is streamed from the Argentinian studio). LatAm studio number two located in Columbia went live just this month.

Another European studio is planned to open before the end of the year. Then a further 3 or 4 new studios in 2024 in North America, LatAm and Europe. The North American and European locations weren’t disclosed. The third LatAm studio will likely be a larger installation in Columbia, significantly expanding the capacity of small studio just opened there.

Constructing the studios on time will be a challenge. As will finding and training the necessary personal to keep them running. The growth in Evolution’s staff headcount in recent years was another eye opener in the presentation: from 6,700 staff in the middle of 2020 to just under 18,000 now!

Revenue growth

Table capacity constraints may be seen as a real threat to revenue growth. But it’s not entirely curtailing it.

January to September 2023 operating revenues came in at just over €1.3 billion representing a 26% increase on the same period in 2022. The company is still yet to experience a year on year decrease in operating revenue.

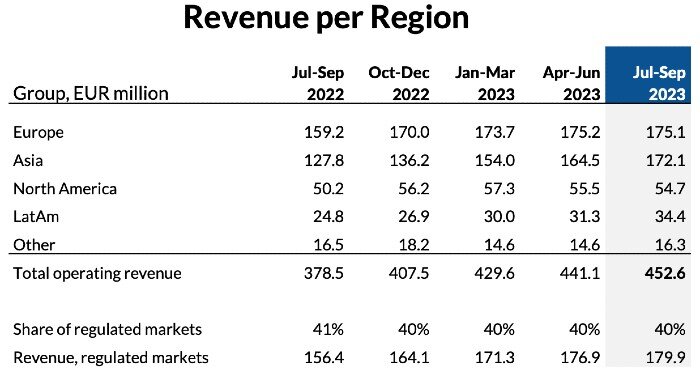

In terms of which regions are driving growth, the below graphic is revealing.

While Europe remains Evolution’s largest market (now by only a whisker), it is also its most mature, growing marginally month on month. Asia meanwhile saw a near 35% rise on Q3 2022 and will likely become Evolution’s biggest market in the last quarter of this year and beyond.

Growth in LatAm has been rapid, albeit from a small base. While North America is still viewed as a future growth driver, but the pace of this growth has more to do with how quickly new states regulate than country-wide demand.

Leave a Reply

Want to join the discussion?Feel free to contribute!